capital gains tax rate 2021

Long-term capital gains are taxed at. 18 and 28 tax rates for.

Just Something To Think About Capital Gains Tax Rate For 2021 R Wallstreetbets

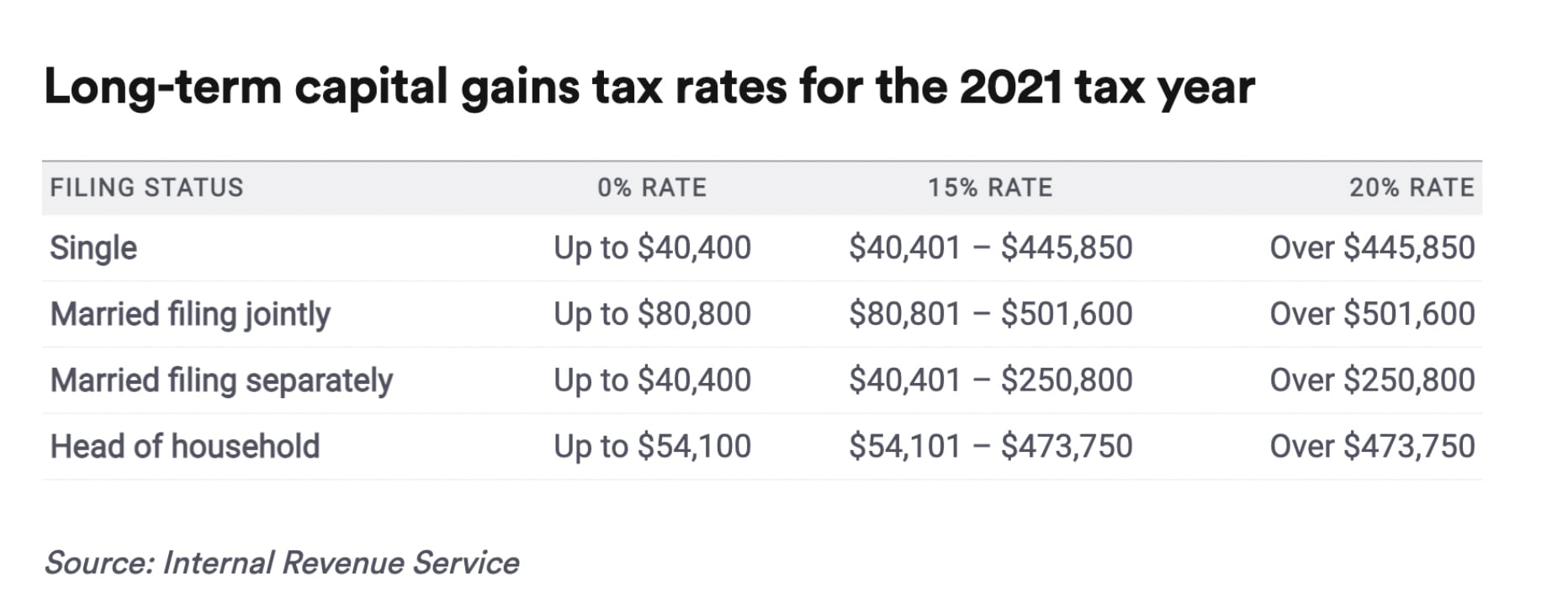

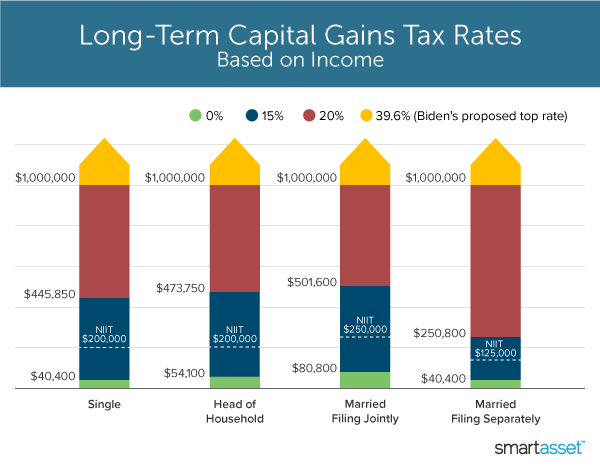

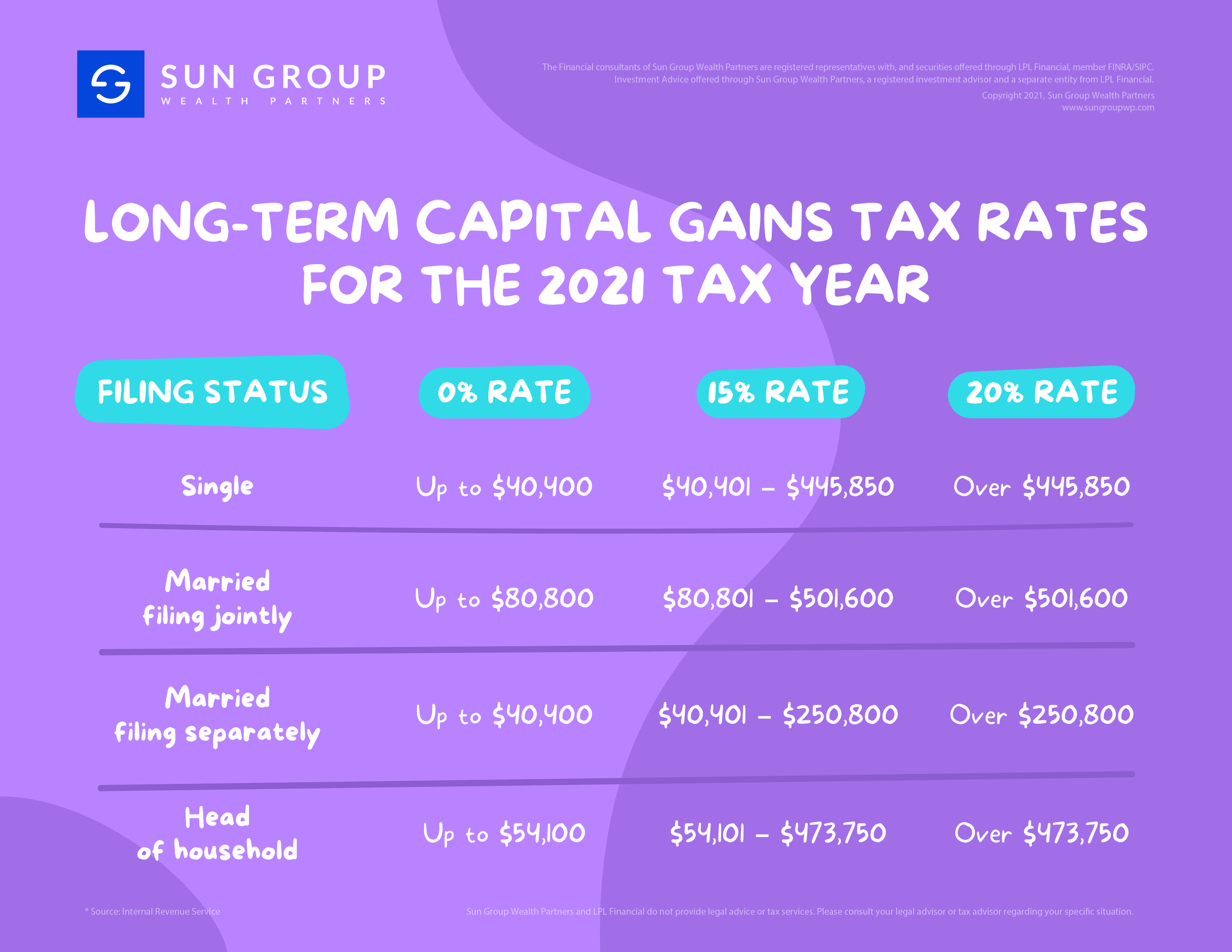

The tax rate that applies to your long-term capital gains depends on your taxable income.

. 1706 shall be filed and paid within thirty 30 days following the sale exchange or disposition of real property with any Authorized Agent Bank. Find out more. The following are some of the specific exclusions.

However it was struck down in March 2022. Tax rate based on income. First deduct the Capital Gains tax-free allowance from your taxable gain.

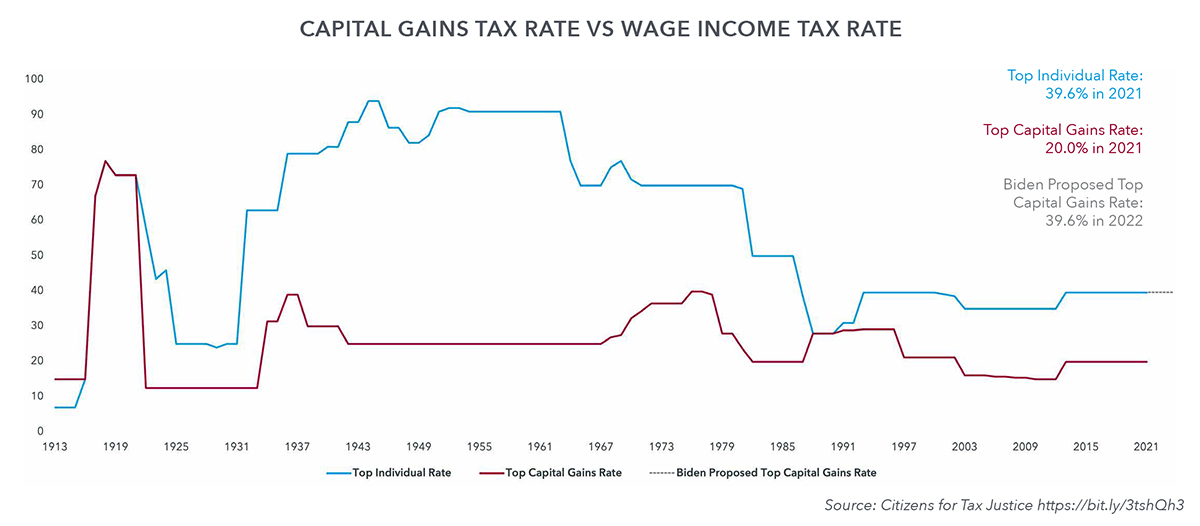

Profits from the sale of an investment such as shares of a stock or real estate are subject to capital gains taxes. If your income grew by 5 2000 in 2023 your 2023 tax income of 42000 would bump you up to the 15 long-term capital gains tax rate if not for the inflation. 2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains For Unmarried Individuals Taxable Income Over For Married Individuals Filing Joint Returns Taxable Income.

2021 Short-term capital gains tax rates. Lifetime capital gains exemption limit For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption. The following Capital Gains Tax rates apply.

Some or all net capital gain may be taxed at 0 if your taxable income is. Oregon taxes capital gains as income and the rate reaches 99. Tax-free exchange is a tax deferred exchange in which one pays capital gains taxes for exchange of a property not when the transfer takes place but on a later date.

Capital gains tax reporting deadline changes. The federal government assesses capital gains taxes at the following rates. Events that trigger a disposal include a sale donation exchange loss death and emigration.

Autumn Budget 2021 key points. To get a copy of the PDF select the tax table you need and go to the heading. Long-term capital gains can apply a.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. 2021 Capital Gains Tax Rates. Capital gains tax CGT is the tax you pay on the profit when you sell.

Rates for short-term capital gains are higher. The tax rate on most net capital gain is no higher than 15 for most individuals. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018 2016 to 2017 2015 to 2016. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Capital Gain Tax Rates.

There are two main categories for capital gains. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. How much these gains are taxed depends on how long the asset was held.

Whats new for 2021. Wisconsin taxes capital gains as income. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

The Capital Gains Tax Return BIR Form No. Add this to your taxable income. Short-term capital gains are taxed at your ordinary income tax rate.

Weve got all the 2021 and 2022 capital gains. Tax tables with an asterisk have downloadable look-up tables available in portable document format PDF.

Oregon S Capital Gains Tax Is Too High Oregonlive Com

Effects Of Changing Tax Policy On Commercial Real Estate

Income Tax And Capital Gains Rates 2021 03 01 21 Skloff Financial Group

2021 Capital Gains Tax Rates By State

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Can Capital Gains Push Me Into A Higher Tax Bracket Quarry Hill Advisors

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Find Out Crypto Tax Rates For 2022 Tax Year 2021 In One Glance

2021 2022 Capital Gains Tax Rates And How To Calculate Your Bill

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

2022 Income Tax Brackets And The New Ideal Income

Crypto Capital Gains And Tax Rates 2022

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

What S In Biden S Capital Gains Tax Plan Smartasset

2021 2022 Capital Gains Tax Guide Short And Long Term Sofi

State Taxes On Capital Gains Center On Budget And Policy Priorities

Short Term Vs Long Term Capital Gains White Coat Investor

Long Term Capital Gains Tax Rates For The 2021 Tax Year Sun Group Wealth Partners