child tax credit portal update dependents

To complete your 2021 tax return use the information in your online account. Do not use the Child Tax Credit Update Portal for tax filing information.

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

The IRS has recently launched the.

. The Update Portal is available only on IRSgov. Families can now claim up to 50 percent of qualifying expenses up from 35 percent previously. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

To access this portal users need an IRS username or an IDme. The tool also allows families to unenroll from the advance payments if they dont want to receive them. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving.

You can use it now to view your payment history. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. Later this year the Child Tax Credit Update Portal CTC UP will be updated to allow you to inform us about the qualifying children you will claim on your 2021 tax return so that we can adjust your estimated 2021 Child Tax Credit and therefore adjust the amount of your monthly advance Child Tax Credit payments.

You can also refer to Letter 6419. The IRS will make a one-time payment of 500 for dependents age 18 or fulltime college students up through age 24. To reconcile advance payments on your 2021 return.

The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child tax credit payments to update their income. A nonfiler portal lets you provide the IRS with basic information about yourself and your dependents if you normally. Families should enter changes by November 29 so the changes are reflected in the December payment.

Claiming the child and dependent care tax credit. Heres how they help parents with eligible dependents. Once that functionality is available you can use the Child Tax Credit Update Portal to submit your new dependents information to the IRS and update your payment amount.

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. Child Tax Credit Update Portal. It also lets recipients view.

This tool can be used to review your records for advance payments of the 2021 Child Tax Credit. Child Tax Credit Update Portal. To add or change your bank you can do so through the Child Tax Credit Update Portal.

The updated information will apply to the August payment and those after it. COVID Tax Tip 2021-167 November 10 2021. The child tax credit is a credit that can reduce your federal tax bill by up to 3600 for every qualifying child.

If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you file in 2021. Child Tax Credit Update Portal. Alternatively you can make adjustments eg.

If you do not update your information with the IRS during 2021 you can still claim the credit for that qualifying child when you file your 2021 tax return. You can update your number of dependents starting in September. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal.

This website provides information to help the public understand the Child Tax Credit and advance Child Tax Credit payments. Other features coming to the portal include viewing payment history and updating dependents. The Child Tax Credit Update Portal now also allows users to add or modify bank account information for direct deposit.

It also provided monthly payments from July of 2021 to December of 2021. At some point the portal will be updated to allow you to update how many dependants you have. Once that threshold exceeds that number the credit percentage rate starts to phase out from 50 percent.

To access this portal users need an IRS username or an IDme. Get your advance payments total and number of qualifying children in your online account. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment.

This information is not tax advice and cannot be used to sustain a legal position. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The child tax credit can significantly reduce your tax bill if you meet all seven requirements.

The child and dependent care tax credit was expanded under the Rescue Act. Enter your information on Schedule 8812 Form 1040. Updating the portal or any changes next year could also result in an additional payment next year if you were underpaid.

For tax years through 2020 the dependent care credit is 20 to 35 of qualified expenses. The Child Tax Credit Update Portal allows users to make sure they are registered to receive advance payments and update bank account information for direct deposit. For official guidance please see IRS Publication 972 Child Tax Credit and Credit for Other Dependents.

The Child Tax Credit Update Portal allows taxpayers to make sure their household information is correct check payment status and unenroll from the. Child Tax Credit Update Portal. Other features coming to the portal include viewing payment history and updating dependents.

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021.

Irs Child Tax Credit Letter What It Means And What To Do With It Cnet

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Dependent Children 2021 Tax Credit Jnba Financial Advisors

The Web Applications Are Generally Made From Html Css And Java Scripting Other Languages Used For Parenting Techniques Positive Parenting Positive Discipline

Can I Claim My Elderly Loved One As A Dependent On My Taxes Tax Deductions Types Of Taxes Deduction

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Turbotax Mobile App Turbotax App Tax Preparation

Paying For College Is One Of The Most Common Concerns I Hear About From Students And Parents The Peo Saving For College College Savings Accounts College Costs

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

How To Avoid An Irs Audit Debt Relief Programs Irs Tax Debt

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Irs Child Tax Credit Payments Start July 15

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

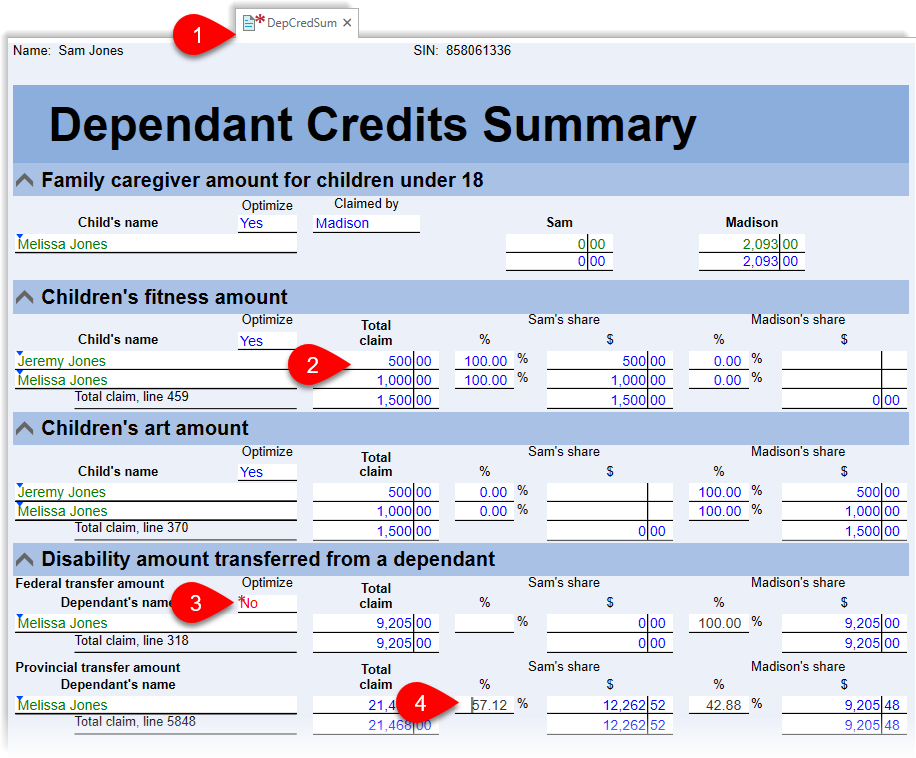

Dependant Tax Credits Dep Depex Depcredsum Taxcycle

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back